13 Months Later: How Did Inflation Change Purchasing Behavior?

This blog post summarizes the recent Veylinx webinar, “13 Months Later: How did inflation change purchasing behavior?” Watch a replay here for more insights.

Soaring inflation has made it harder for CPGs to understand how much consumers value a product or innovation. A new Veylinx tracking study — testing consumer behavior in October 2021 and again in November 2022 — sought to reveal how buying habits and attitudes have been affected by rising prices.

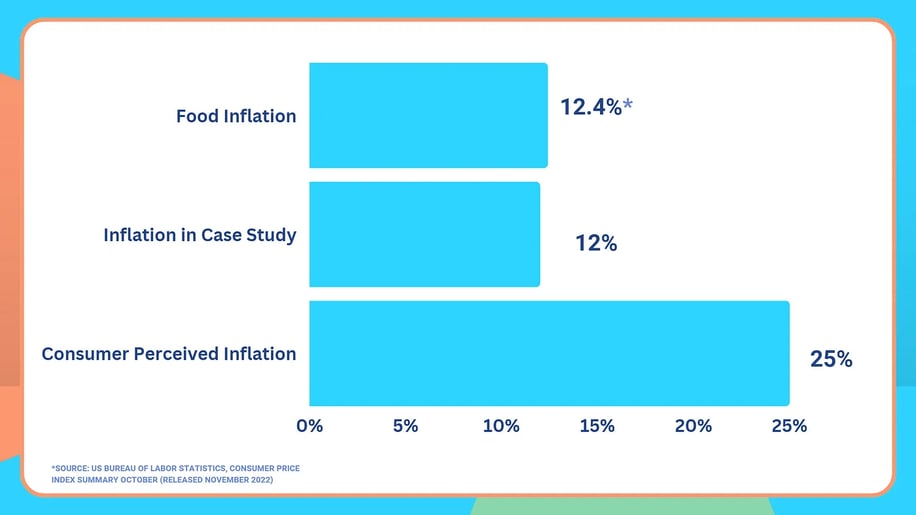

According to the US Bureau of Labor Statistics, the consumer price index summary from October 2022 (released in November 2022) shows food prices to rise at an average of 12.4% annually. The Veylinx study, too, showed inflation to be around 12% over the past 13 months. However, consumers perceive inflation to be more than double the actual inflation rate, at a whopping 25%.

Why do consumers overestimate rising prices?

If we zoom out, consumers’ exaggerated perception of inflation makes sense. To understand why, it’s crucial to realize that inflation affects all costs around us. Roughly 70% of spending goes to fixed expenses like housing, transportation, pension plans, and healthcare — all of which are increasing. Wage growth is rising, too, but only at about 5.1% in the 12 months to October. This leaves the average American consumer with 21% less discretionary funds to spend on variable costs like food, entertainment, apparel, and services.

With 21% less spending power, price sensitivity has increased. This has made consumers rethink their spending habits. For example, 50% of consumers are eating out less than they were previously. There are various other ways consumers are trading down, trading out, or exercising price sensitivity by purchasing more products at discounts.

Determine the right product price during inflation

It is clear that consumer buying behavior is changing, which means that brands can’t simply rely on historical data when they take pricing action. Successful price adjustment — especially in the current environment — can be tricky, so viewing prices through three separate lenses is crucial and finding the sweet spot between them.

- Cost-focused lens: understand the cost of goods and add a margin to set the selling price.

- Category-focused lens: evaluate the competitive landscape. Based on the competitive prices and the category, set an attractive price.

- Value-focused lens: understand product value to consumers and base price on that.

Inflation In a nutshell:

Consumers have less money and are changing their buying habits accordingly. To adjust and counter this shift in the market, brands should:

- Understand the role of the category and their role within that category

- Understand psychological pricing thresholds and not exceed them

- Invest in innovation — but innovation needs to be relevant.

How Veylinx can help:

- Find strategic price points

- Reveal the added value of innovations

- Simulate the effect of price changes within your category

Tags:

December 19, 2022

Comments